EMV Credit Card Processing

By using EMV-enabled terminals that accept Chip and PIN cards, merchants can avoid liability for disputed or fraudulent card transactions.

EMV (Europay, Mastercard and Visa)

EMV is a fraud-reducing technology designed to protect issuers, merchants and consumers alike against the losses that can be incurred from counterfeit, lost or stolen cards at the point of sale. This chip technology adds layers of security against fraud while being virtually impossible to duplicate.

Reduce fraud

Making the switch to an EMV credit card processing device will reduce your liability for fraud cases. Prior to EMV, credit card issuers were responsible for any funds stolen when a fraudulent transaction was approved. Now, whichever party is least compliant with the new EMV system owns the liability. So, mitigate your liability exposure by transitioning to UTA’s EMV solution.

Benefits

Reduce credit card processing fees

Reduce compliance exposure

Apply a surcharge fee to all credit card payments

UTA/Worldpay provides superior card network compliance

Compliant surcharge solution will calculate and apply the fee automatically

Card validation occurs at the point of card entry-only qualified payments are surcharged

Only surcharge credit cards and not debit cards

No software to purchase

Real time reporting online - 24/7

Frequently Asked Questions

Find answers to commonly asked Credit Card EMV questions.

our products

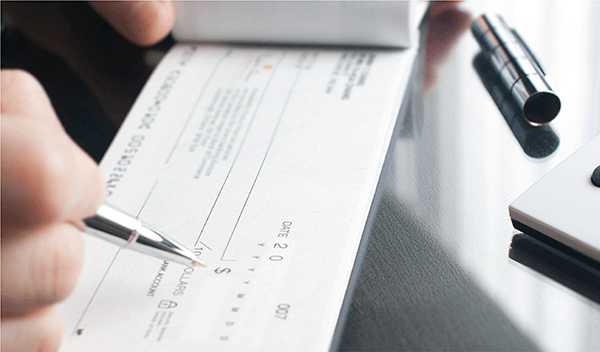

Check Guarantee

Eliminates the risk of fraudulent checks and collection headaches.

Credit Card

Providing innovation and technology that optimizes your credit card acceptance program.

ACH Payment

Enables you to accept payments from your customer’s bank account quickly, safely in a secure internet environment.

Online Bill Pay

Empower your company to accept ACH or Credit Card customer initiated payments on your website.

Remote Deposit Capture

Scan your checks for instant bank deposits, with no returns.

Mobile Deposit

Guarantee and deposit your company’s payments anytime, anywhere, 24/7 with UTA’s Mobile Deposit solution.